AppLovin: A Solid Discount On An AI Printing Press

AppLovin APP, a stock that has defied gravity by growing from roughly $60 to over $740 in recent years, is currently sitting in a huge YTD correction.

At $473 per share, the “smart money” is hesitating because of a short report and a few months of silence, but for those of us who look at fundamental operational leverage, this is an asymmetric entry point ahead of the February 11th earnings release.

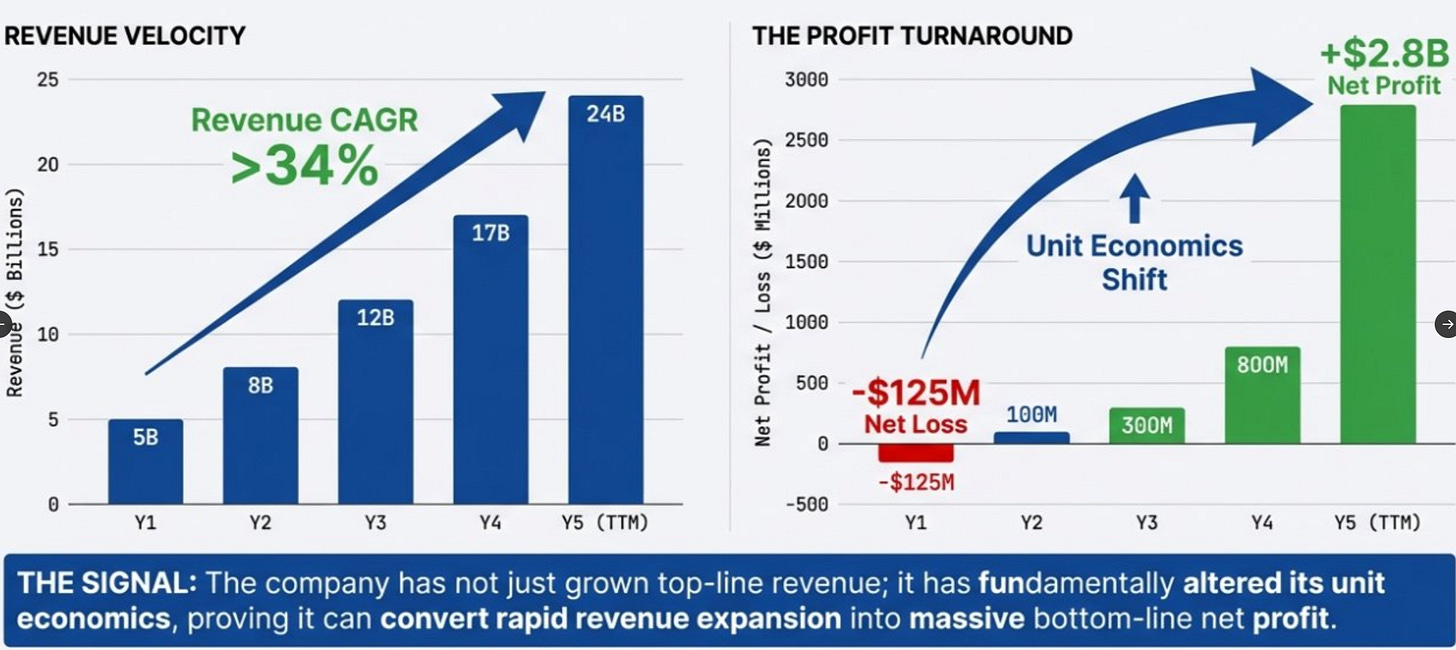

We’ve seen this movie before. AppLovin isn’t just a mobile games company anymore; it has successfully pivoted into an elite advertising technology challenger that is beating the giants at their own game.

By focusing entirely on its Advertising segment and the deployment of its AXON 2.0 engine, the company has positioned itself as a mission-critical tollbooth for digital growth.

From Niche Player To Ad-Tech Dominance

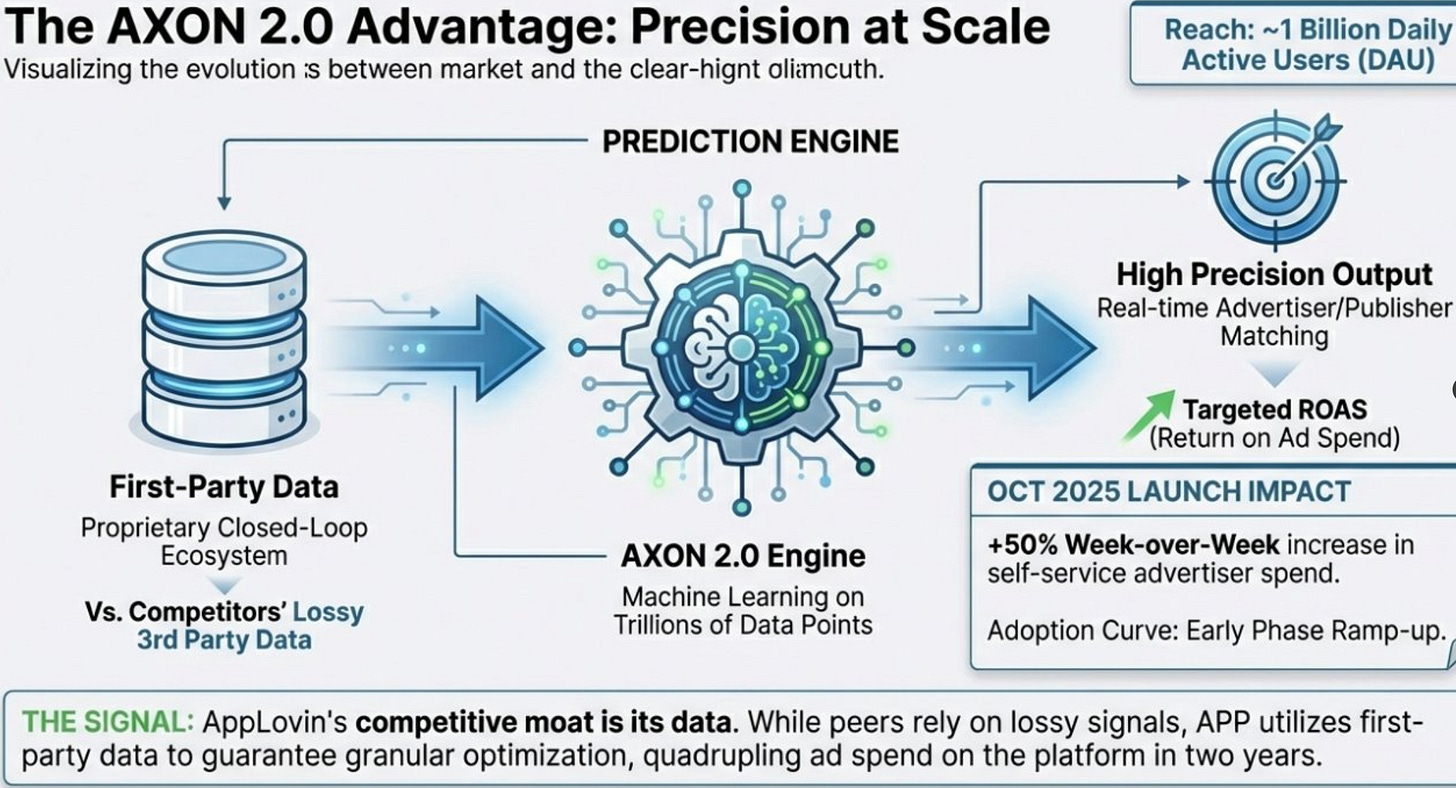

The secret sauce here is AXON 2.0. It’s a proprietary machine learning engine that processes trillions of data points to make real-time predictions for ad auctions.

It sounds like technical jargon, but in a nutshell, it’s a high-precision ROI machine. Unlike its peers who are struggling with “lossy” third-party data in a post-privacy world, AppLovin leverages its own first-party data to hit Return on Ad Spend (ROAS) targets with surgical accuracy.

Think about that for a moment. This competitive advantage allowed AppLovin to quadruple its ad spend in just two years.

When you have better data, you get better results; and when advertisers get better results, they don’t just stay on the platform they double down. This isn’t just theory; we’re seeing it in the adoption of the AXON Ads Manager launched in October 2025.

In just the first few weeks, overall spend from self-service advertisers surged 50% week-over-week. Management is guiding for 12% to 14% QoQ revenue growth, and I believe the current customer base of ~1 billion Daily Active Users (DAU) provides a runway for expansion that is almost incomprehensibly large.

The Short Report Fallacy

The current YTD correction is largely a reaction to a recently published short report. I’ve seen this play out with UnitedHealth and Alibaba; the market focuses on headlines while the underlying fundamentals remain intact, if not stronger.

Management has already rejected the capital structure concerns raised, asserting full compliance with the SEC.

Sometimes the market hands you gifts wrapped in fear. If you have strong conviction backed by fundamental analysis, volatility becomes your friend rather than your enemy.

After divesting its first-party games portfolio, AppLovin is now a simplified, lean, and high-margin enterprise software platform. Judging it by the “games” label of 2021 is like judging Nvidia by its gaming GPUs while ignoring the $100 billion AI infrastructure demand.

82% EBITDA Margins

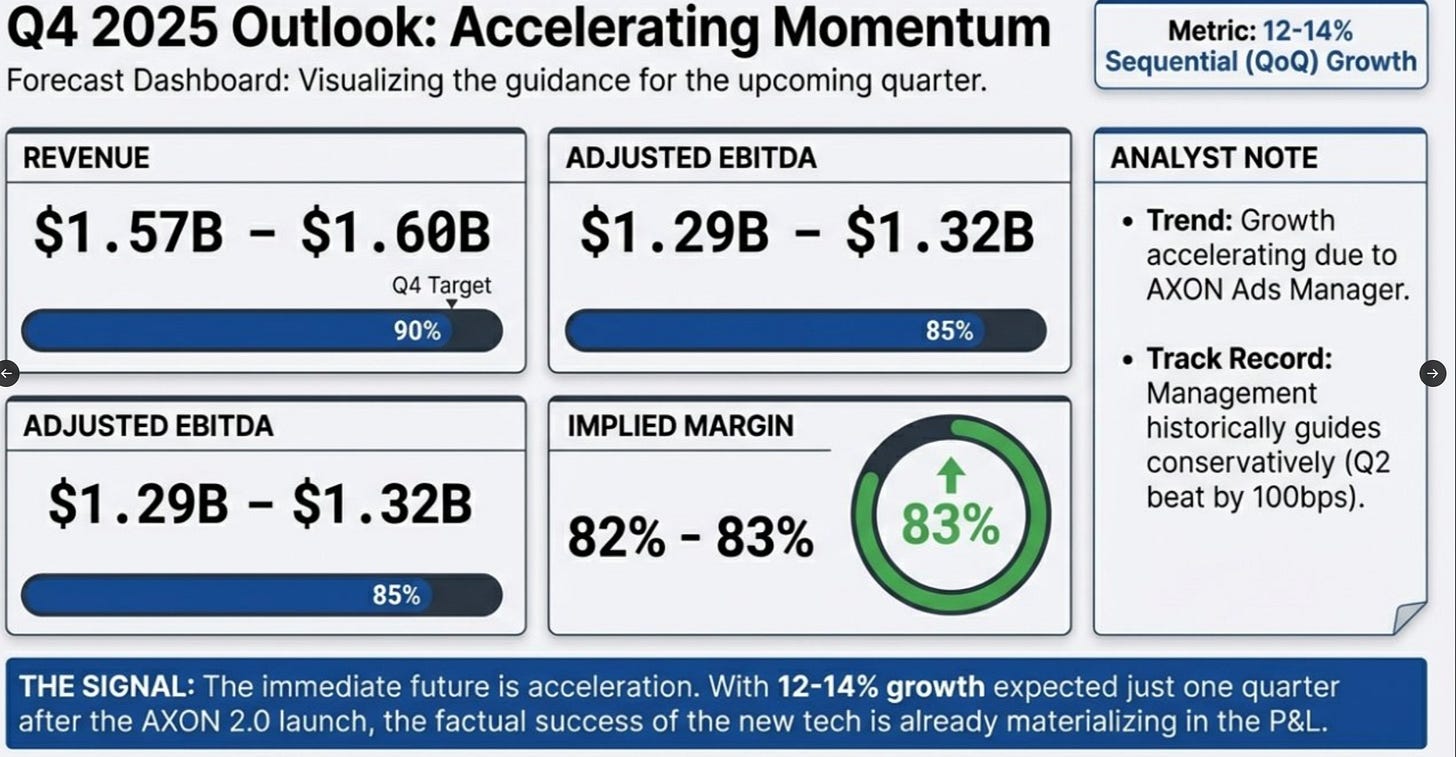

What really separates the elite from the average in tech is operating leverage. AppLovin’s adjusted EBITDA margins for Q3 2025 hit a staggering 82%, up from 77% the year prior. Management is targeting 82% to 83% for Q4.

To put that in perspective, Microsoft the gold standard of software maintains a gross margin around 70%. When you can translate over 80% of your revenue into EBITDA, and most of that into Free Cash Flow (FCF), you aren’t just a business; you’re a recurring revenue machine.

Analysts were modest after the Q3 report, barely lifting consensus figures. This is actually a positive setup for the February 11th call. The bar has been lowered, making it easier for AppLovin to beat on the bottom line.

If the firm repeats its Q2 success and hits the upper end of its EBITDA guidance, we are going to see a massive re-rating opportunity.

Why APP Is Dirt Cheap At $473

The market is pricing AppLovin at less than 39x FY2026 earnings and 30x FY2027 earnings. While those multiples might look high to a value investor, they are reasonable when adjusted for growth.

We are looking at an expected EPS CAGR of 25.9% and Revenue CAGR of 30.2% over the next five years.

Using a PEG ratio of 1 (a standard metric for high-growth tech), the math becomes very compelling:

PEG = 1

EPS Growth = 56.63%

EPS = $14.64

Justified Fair Value = $829.06 per share

At the current price of ~$473, we are looking at an upside potential of 60% over the next 12 to 24 months. You are essentially getting a software-driven cash cow at a discount because the market is distracted by a short report and “yesterday’s narrative”.

AppLovin is no longer just a mobile app company; it is the infrastructure powering the next generation of digital advertising. With the AXON engine driving triple-digit efficiency gains and a margin profile that puts Big Tech to shame, the current dip is a golden opportunity. I am bullish for the medium term and expect the upcoming earnings to be the catalyst that brings everyone back to reality.

Disclosure: I may or may not have a beneficial long position or Short in any of the securities discussed, either through stock ownership, options, or other derivatives. This article expresses my own opinions not a financial advice.

Look I just wanna Cover my Ass Investing is Risky. Stay Safe.

Trade Idea

Now backt the trade Idea given the high Implied Volatility (IV) surrounding the current selloff and upcoming earnings historically resulting in an implied straddle of 15% the option premiums are officially “juiced”. Rather than catching a falling knife by buying shares outright, I’m looking to exploit this volatility by […..]. This allows us to either buy the dip at an even more discount or pocket the $2,650 bucks in 25 days if the stock stabilizes.

Since I launched this Substack in October I’ve published 9 in-depth, actionable investment theses that I’m personally holding.

Here’s the result so far:

Micron +112%,

Lam Research +69%,

Eli Lilly +25%,

Novo Nordisk +30%,

Exxon +24%, and more average return: +31.8% vs S&P +4% since Oct.

If you find the free research useful, upgrading is the best way to keep it alive.