Oversold Bounce Setup: MSTR & SLV on Deck Today | Daily Trade Ideas

Good morning fellas,

Happening Now

It’s a jittery start to the morning in premarket trading, with futures wavering amid ongoing concerns over AI adoption costs and reactions to big tech earnings. Volatility is edging higher as investors digest Alphabet’s hefty capex guidance and broader tech sell-offs from the prior session, while Bitcoin takes a sharp hit, signaling a crisis of faith in risk assets.

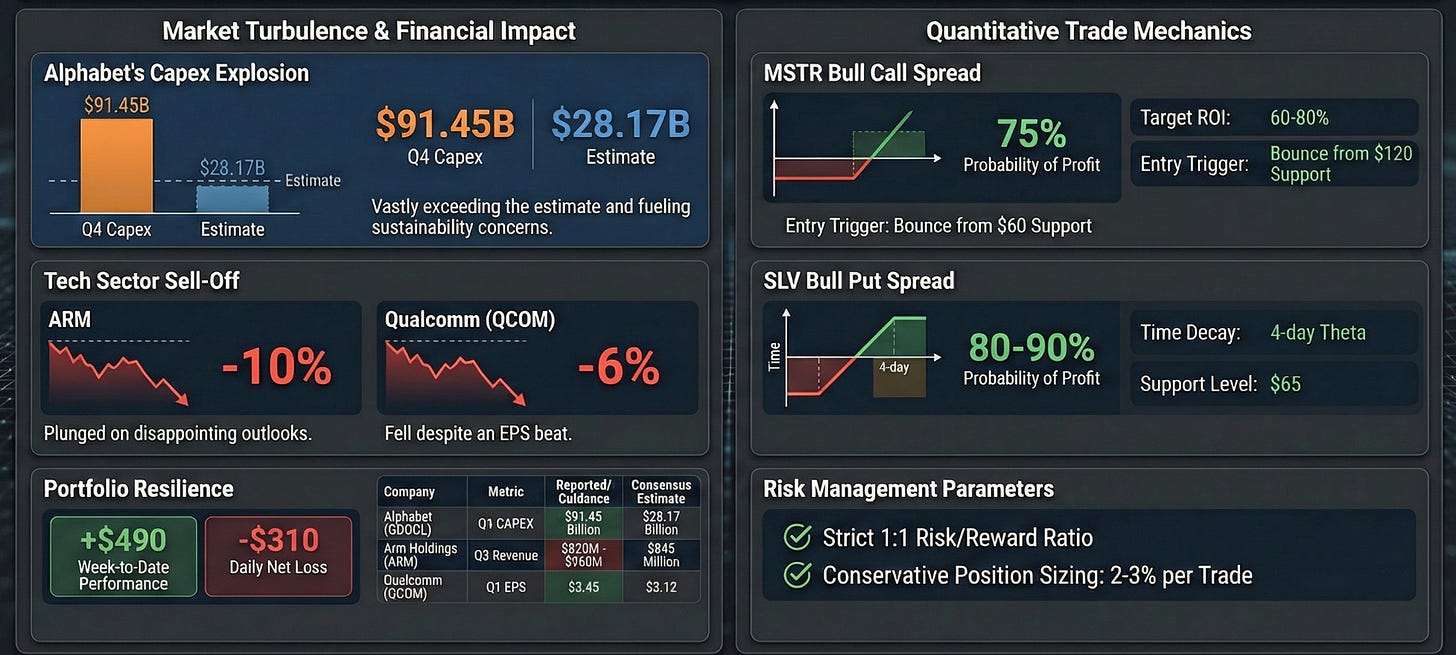

Alphabet (GOOGL) -2.8% Gapped lower after reporting Q4 2025 results with CAPEX soaring to $91.45 billion, far exceeding estimates of $28.17 billion; the company forecasted 2026 capex between $175-185 billion, raising question on AI spending sustainability.

Qualcomm (QCOM) -6% tanked on mixed Q1 2026 guidance despite beating EPS estimates at $3.45 vs. $3.12 expected and revenue of $11.2 billion topping $10.8 billion; concerns over handset demand and China exposure are weighing in.

Arm Holdings (ARM) -10% tanked after its fiscal Q3 outlook disappointed, with revenue guidance of $920-960 million falling short of $945 million consensus, amid slowing growth in AI chip design. There is a continued weakness in the tech sector but today I am expecting a stablization.

What Happened Yesterday

Let’s recap the trades from yesterday’s edition they didn’t go as planned, but that’s the market for you. I got stopped out on both to protect capital.

Overall, it was a small hit: down about $310 net, but nothing that derails the week. Remember, not every setup wins but sticking to risk rules keeps the account intact for the next opportunities.

Starting with AMD: The bull call spread (buy $212 call, sell $230 call, Feb 18 exp) was positioned for a bounce off that $208 $210 support after the earnings dip. We entered at a $4.50 debit, targeting a quick 3-5% pop to double the premium.

Unfortunately, tech pressure intensified throughout the day AMD broke below $210 on heavier volume, triggering the stop below $205. I closed out for a $180 loss per spread.

Next, the QQQ bull put spread (sell $610 put, buy $600 put, Feb 5 exp): This was a neutral-to-bullish credit play on the range bound action, entered for $1.10 credit after the open.

We needed QQQ to hold above $610 by expiration for full profit, but the Nasdaq faded harder than anticipated, dipping below breakeven amid AI spending jitters from big tech reports.

Hit the stop (breakeven minus 35% of credit), closing for a $130 loss. Range plays work great in chop, but yesterday’s momentum shift reminded me to tighten stops when VIX spikes intraday.

Week-to-date, I’m still up $490 after factoring this loss in, thanks to earlier wins.

Now, let’s talk trades.

After yesterday’s stops on AMD and QQQ small losses, but they reinforced the need for tight risk controls in this environment. I am shifting focus to setups with stronger multi-timeframe support levels.

The market’s still jittery with AI capex concerns lingering, but these charts show oversold conditions and historical bounce zones that scream high-probability reversals. Keeping expirations short (1-7 DTE) to let theta work while capping exposure. Position sizing stays conservative at 2-3% per trade, and I’m only entering post-open confirmation.

Starting With MSTR

The weekly chart paints a classic bottom-fishing opportunity: MSTR’s plunged to multi-year support around $115 to $120, with RSI deeply oversold at levels that have sparked rallies before. Volume’s thinning on the downside.

The 2-hour view confirms the exhaustion, with price coiling near lows and RSI at 32, hinting at a snapback if Bitcoin stabilizes (given MSTR’s correlation).

I’ve been using bull call spreads on these for limited-risk upside plays, betting on a 5-8% rebound without overcommitting capital.

Here’s how I play it:

Wait for the open and watch for a hold above $120 no entry if it cracks. Open the MSTR option chain (target 3-7 DTE for decent premium without excess time risk).

NOTE: These option trades are multi-leg complex trade structures, so the Debit or Credit on these trades may differ due to the IV and Price change but the strategy and trade ideas is the remains the same.

Buy an ATM call around $120 strike (Maybe 45 delta, ~$7.5 debit 8DTE).

Sell a higher call at $135 strike (~$4 credit).

Net debit: $3.5-4 per spread.

Margin: None (debit spread); max loss is the debit.

Probability of profit: 75%, aiming for 60-80% ROI on a quick pop to $130+.

For risk management: 1:1 risk/reward stop out if MSTR is below $116 on monday, capping loss at $150 to $200 per spread.

Next up, SLV

SLV’s testing strong support at $65 where it’s bounced multiple times historically, with the red trendline acting as a floor amid the pullback. RSI at 30 is nearing oversold, and volume spikes on greens suggest buyers stepping it is perfect rebound play if metals sentiment firms up.

For these, I favor bull put spreads to collect premium on the range hold, turning time decay into an ally while silver consolidates.

Here’s the play:

Post-open, confirm no breakdown below $65.50. Pull up SLV options (4DTE for fast theta burn).

Sell a put OTM around $65 strike ($3.5-4 premium).

Buy protection lower at $62 ($1 to $1.60 cost).

Net credit: $1.80-2.50 per contract.

Margin: $500 per spread. (Maybe More)

POP: 80-90%.

Risk: Strict 1:1 stop if breakeven breached by 25% of credit, limiting loss to $150 to $170. This setup delivered steady wins in prior commodity dips expecting similar here.

Markets remain tense, but these support zones offer edges worth trading with discipline. After yesterday’s hits, I’m sizing smaller and watching correlations closely.

If you want to join me for day to trade in real-time with me join the chat.

The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.